Executive Summary

Nuclear energy can be either very cheap or very expensive. Much ink has been spilled recently attempting to establish what the true ‘cost’ of nuclear is, as though that is some fixed objective fact. In practice, the cost of nuclear energy depends on policy choices about how a nuclear fleet is planned, procured, and operated. Getting these choices right is key to ensuring nuclear power is attained at a low price. This report attempts to inform some of those policy choices, by taking a survey of eight different countries and comparing key attributes of their industry that have been determined by policy, and the key outcomes in their nuclear build programs in terms of the cost and time to construct nuclear generating capacity.

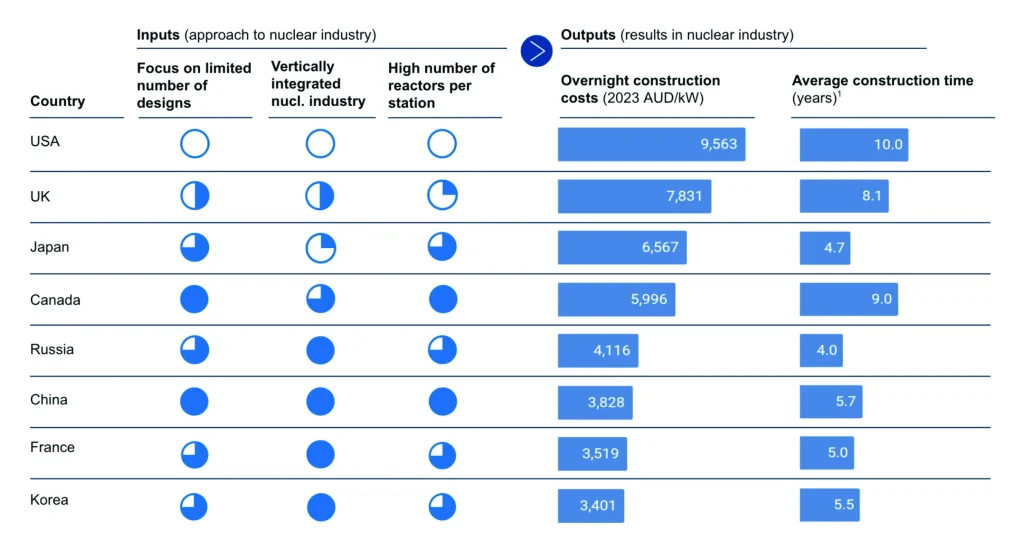

The primary observation is that nuclear energy appears to benefit from high degrees of concentration and scale, in both the technical and corporate sense. This finding can be summed up in four lessons on how to do nuclear well:

- Fewer design types: Successful countries concentrate their efforts on a limited number of reactor designs. These designs may be evolved and improved slowly and iteratively, but significant conceptual leaps are rare, and costly. Maintaining a diverse range of different reactor designs or concepts appears to be difficult, as it dilutes the industrial experience and stretches supply chains more thinly across the different concepts. Rather than ‘testing’ multiple different designs or insisting on an original design, Australia should select a design that has worked well overseas.

- Fewer generation sites: Successful countries keep costs down by building more reactors at fewer generation sites, thus benefitting from economies of scale at each site. Many of the establishment costs of nuclear energy are on a ‘per-site’ basis, including establishing water access transmission corridors, attaining social license, and many safety and regulatory overheads. Australia should focus on building larger nuclear plants at a limited number of sites. For example, one large nuclear station could replace the two or three smaller coal plants that support Sydney and Melbourne in the Hunter or Latrobe valleys. Where possible, existing water and transmission assets can be utilised with modest adaptation or extension.

- Fewer independent corporate entities: Successful countries align the interests of the entities responsible for designing (or evolving a supplied design), building, operating and owning the country’s nuclear plants. This is commonly achieved by having a high degree of vertical integration between these roles, frequently to the extent of a single company (or its subsidiaries) being responsible for all stages. This helps to ensure the plant is designed to be built and operated efficiently, built as quickly as feasible to commence operations, but only as quickly as ensures safe, reliable, and efficient operations over the long term. We observe that in countries that can’t sustain multiple competing vertically integrated corporate giants, the nuclear industry may have some of the characteristics of natural monopoly. This means the competition advantages attained by keeping multiple players operating could be outweighed by concentrating experience and capacity in one company.

- Accept government involvement: Successful countries have a high level of government involvement in their nuclear energy industries. Governments are better positioned to capture the broader national security, environmental and power system benefits provided by nuclear energy. Private companies find it difficult to recoup financial gains from these broader societal benefits. Risk of regulatory change is also very hard to price for a private entity, whereas the government rightly owns and controls this risk. The very long lifetimes of nuclear generators are also difficult for a commercial entity to appreciate when facing commercial interest rates. With the sole exception of the United States, every country in the world with an established nuclear power industry has had either significant government ownership in its first reactors, or been driven by privately-owned government regulated utilities; with at least some monopoly rights on electricity distribution to underwrite the investment.

As the debate around nuclear energy progresses, Australian policymakers should seriously consider the lessons from other countries. There appears to be a very strong case for the government being heavily involved in leading the establishment of the nuclear industry. Without government leadership, it seems unlikely that the necessary degrees of concentration and scale to make nuclear most cost-effective will be attained.

Introduction

There is currently bipartisan support in Australia for transitioning our economy to net zero by 2050. However, debate remains around whether a low-emissions, reliable and affordable supply of electricity can be achieved based on predominantly variable, weather-driven supply sources of wind and solar, or whether some contribution from high-reliability power is needed.

Given Australia lacks the geographic formations necessary to produce hydro power at large scale,[1] and assuming carbon capture and storage remains expensive and difficult to scale, we have only one real supply option for providing high-reliability low-emissions power: nuclear. But currently the Australian government is adamant that the ban on nuclear won’t be lifted, citing cost as the reason.[2]

CSIRO’s GenCost report is frequently cited as providing evidence that nuclear is too expensive compared to renewable energy.[3] However, CSIRO’s approach to costing nuclear energy is deeply problematic. They have chosen to sample just one particular project, of one particular reactor design (a novel reactor design), of one particular scale of reactor (small), in one country (the United States).[4] This project hasn’t yet been built, or delivered any power, and was recently cancelled. Yet nuclear technologies today make approximately 10% of global electricity, in 32 nations, from more than 400 operating reactors.[5] Choosing such an isolated, first-of-a-kind, incomplete project of a developmental design as an example isn’t suitable for serious and objective analysis.

In this paper, we propose a more credible and realistic approach to engaging with the costs of nuclear electricity, by examining a larger range of reactors across a number of different countries.

We analyse the nuclear industries of eight countries — the US, UK, Canada, France, Russia, Japan, South Korea and China — including using reactor-level data on costs, construction time and design. This country list isn’t exhaustive. We’ve sampled different parts of the world, and focused on those countries that have built enough reactors, over enough time, that drawing conclusions about trends and averages might be reasonable. We haven’t attempted to produce an exhaustive explanation of the evolution over time of nuclear costs within each country, though we find it varies. Many other researchers have explored the different trends observed within countries,[6] including the impact of changing regulatory requirements[7] and long pauses in construction on nuclear costs. Our research is consistent with those findings; our focus is comparing the structural differences between countries in the approach taken to construction.

We do not attempt to determine what nuclear power would cost in Australia. A quick glance at the history of nuclear will show it has cost different amounts in different countries at different times. Picking the ‘correct’ or ‘current’ price that would apply in Australia with any degree of precision is not possible — at least until you have made some decisions about how nuclear will be built.

This paper’s intent is to inform those decisions. We’re not seeking to answer ‘what does nuclear cost?’ since the credible answers span such a wide band. Instead, we intend to answer ‘how do we build low-cost nuclear?’

Explaining the Survey – Inputs and Outputs

In this section, we analyse the nuclear industries of eight countries, and detailed reactor-level data to draw insights into how Australia can minimise the cost and construction time of producing nuclear power.

This survey assesses six different things that we can observe about the reactor fleets of other countries, which can be roughly divided into inputs and outputs.

The inputs are policy choices made by the countries building nuclear power in terms of establishing the industry and how it runs. In particular, how they concentrate or disperse their efforts into different designs, sites, and corporate entities.

The outputs are the metrics of success, in particular the amount of time and money that countries spend building each reactor, and also the degree to which they’ve been able to export them — which indicates a further degree of competence and confidence above that required for domestic construction. They are explained briefly below.

Inputs – policy choices

- How many different designs are in use across the industry: We generally consider a design to be a vendor and type. Many reactors are incremental evolutions of a core design and concept. For example, we consider Canada’s fleet (made entirely of CANDU reactors), to be a strong focus on a limited number of designs, even though there are several different sizes/generations.

- The degree of vertical integration: We consider the degree to which the designer, builder, owner, and operator are concentrated into fewer corporate entities to determine vertical integration. Exemplars of the highest degree of vertical integration might be Korea or France, where a single state-backed company plays all roles (perhaps by different subsidiaries), contrasting with the US, where a different interest often performs each function.

- How many reactors are on each site: We assess how the reactors in a country’s fleet are distributed across different sites, showing whether most of the reactors are situated in big stations (e.g., 4 or more reactors) or smaller ones.

- Degree of government involvement: We consider the degree of government involvement in the ultimate investment decisions, either by part or full ownership of the relevant entities or establishment of some kind of regulated mandate for a private company. This metric is found in the detailed table in the Appendix.

Outputs – metrics of success

- Overnight construction costs (OCC): The costs of construction alone, excluding financing costs (interest) and owner’s costs. This is as if the project was constructed ‘overnight’.

- Construction time: The length of time from when construction begins to when the power plant enters commercial operation.

- Nuclear reactors exported: The number of nuclear reactors a country has exported to other countries, where the export is a substantial component of the whole power unit and not simply a component such as the reactor vessel. This metric is found in the detailed table in the Appendix.

Note that what we define as ‘construction time’ is sometimes also referred to as ‘lead time’ and defined as the duration of construction and commissioning.[8] Both these metrics are important; OCC because it is the main driver of the cost of the project, and construction time because it determines how quickly the energy system benefits from low-emissions, baseload power — as well as having a significant impact on costs due to the cost of capital prior to operations that generate revenue.

Unsurprisingly, all three of these measures of success are highly correlated. Countries that do well on one tend to also do well on others. Given construction time is a driver of the overall costs of a project, these two measures are particularly correlated.

Global lessons for a nuclear power industry in Australia

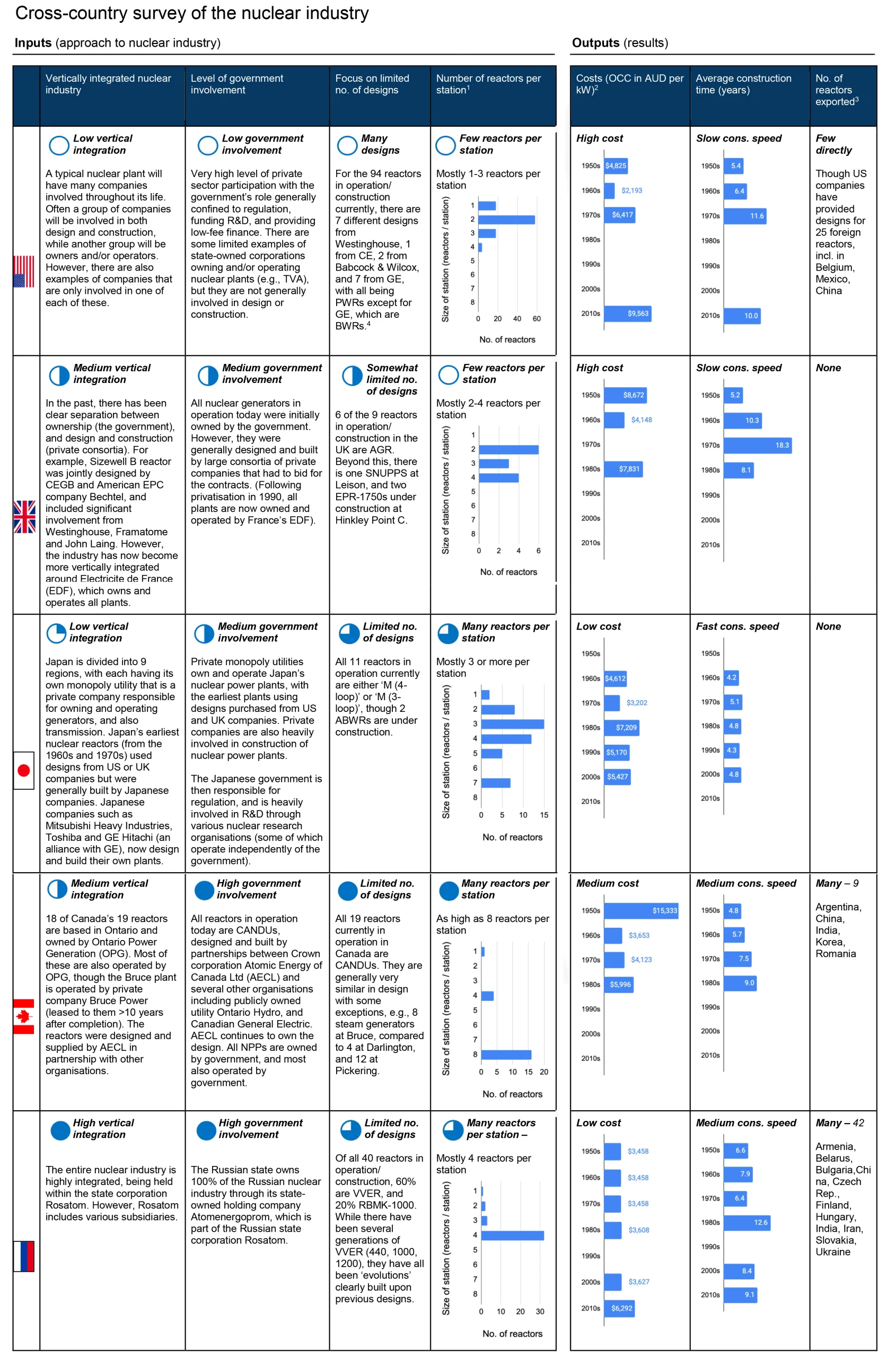

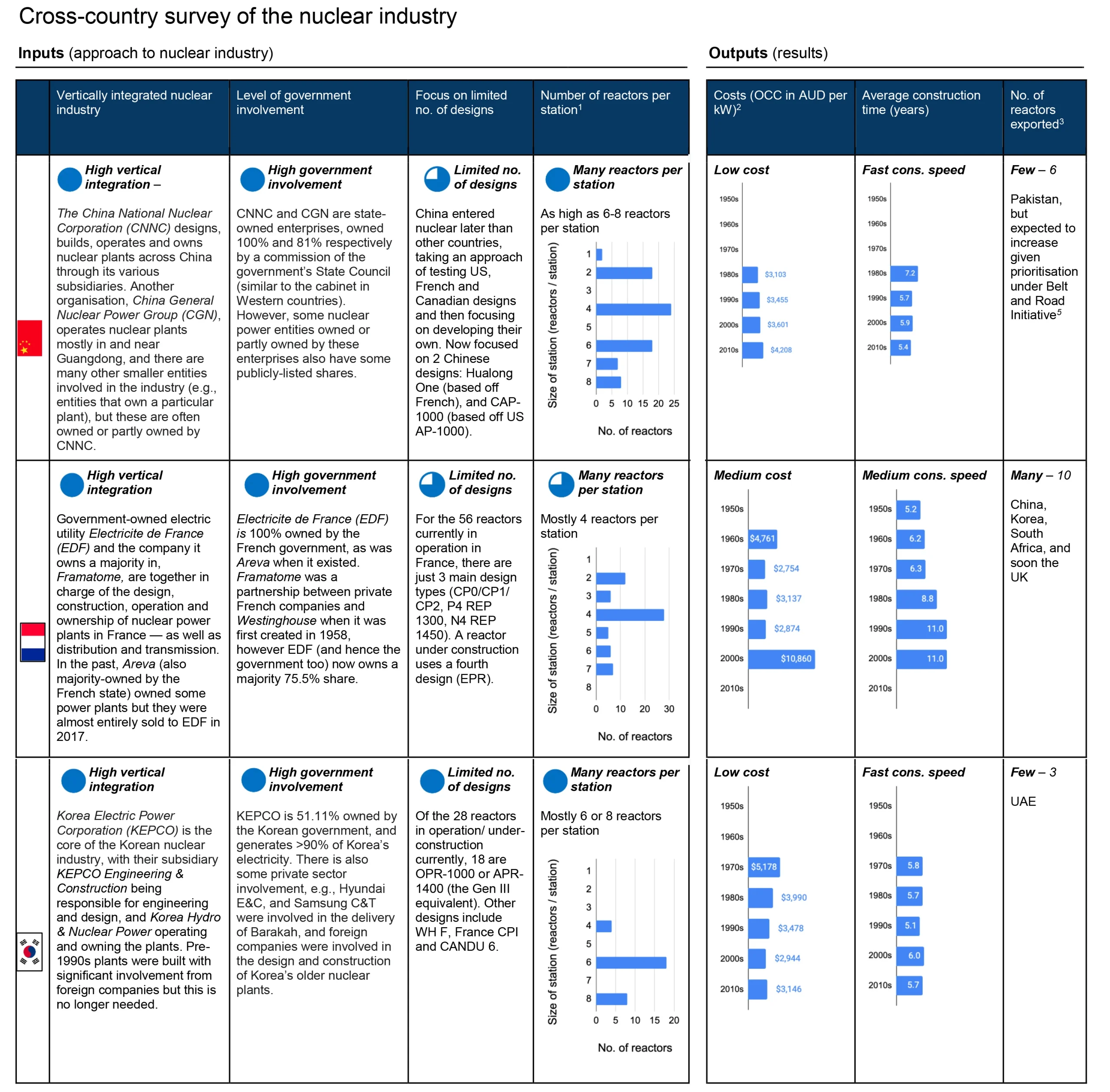

Table 1. High-level summary of our survey of the nuclear industries of 8 different countries, ordered from the highest to lowest in terms of average overnight construction costs over the past 70 years.[9]

See the Appendix for a more detailed summary.

Lesson 1: Fewer design types

The clear winners for lowest construction costs in Table 1 are France and South Korea, which have produced electricity at less than $4000 AUD per kW in overnight construction costs and have relatively short average construction times.

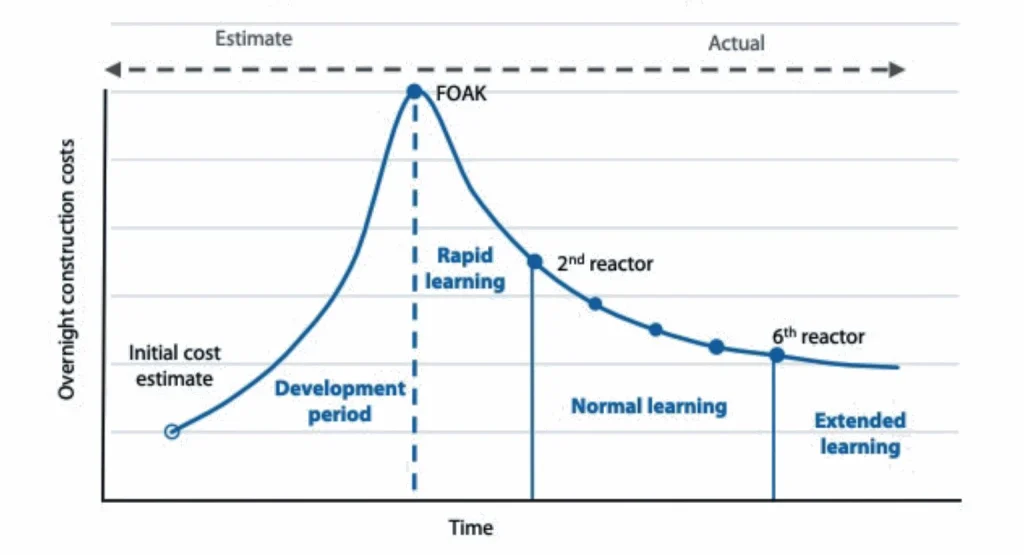

One of the keys to their success is standardisation. These countries have focused on a limited number of designs and become good at making them. They have refined both the design and — equally importantly — the construction methods over many decades. Each nuclear power plant provides learnings for the ones that follow and the number of unforeseen issues that might slow construction decreases with time. The evolutions are generally incremental, and don’t involve radical shifts to new reactor types.

This is in contrast to the country with the highest OCC, the United States, which has many completely different nuclear power designs produced by many different companies. An extreme example is the Arkansas Nuclear One plant, which has two nuclear reactors, with Unit 1 being a Babcock and Wilcox reactor with a Westinghouse turbine generator, while Unit 2 is a Combustion Engineering reactor with a General Electric turbine generator.[10]

These completely different designs even use different cooling water sources, with one reactor using the nearby Lake Dardanelle, while the other reactor uses a 136-metre cooling tower. Despite being immediately next to each other and having the same owner and operator, the potential for economies of scale and learnings between these two reactors is severely limited because of their completely different designs.

This explains a large part of why nuclear power costs are higher in the US than elsewhere. There is a well-known trend in the nuclear power industry that ‘first-of-a-kind’ (FOAK) reactors in a country tend to cost far more than ‘Nth-of-a-kind’ (NOAK) reactors in the same country, as Figure 1 illustrates. By having too many FOAK reactors, the US has missed opportunities for moving down the cost curve.

Figure 1. Nuclear new-build learning curve.[11]

Furthermore, the steepness of the cost curve may be even greater with modern Generation III nuclear reactors. A 2022 MIT study has shown that the second-of-a-kind AP1000 nuclear reactor plant in the US should cost 53% less than the FOAK one (Vogtle), and that the 10th-of-a-kind reactor should cost 68% less than the FOAK one.[12]

So, what does this mean for Australia?

First, rather than ‘testing’ multiple different designs, Australia should select a design that has worked well overseas. Second, there is no place for being parochial about wanting an ‘original’ Australian design. An Australian nuclear power plant will employ hundreds, possibly thousands of Australians, and will by definition be built in Australia. Reinventing the wheel with a new design would only increase the project costs and construction time.

Lesson 2: Fewer generation sites

We measured the concentration of nuclear power within sites in a country by assessing the proportion of a country’s reactors that are based at a nuclear power plant with four or more reactors on each site. For the two most expensive countries, the US and UK, this number is just 4% and 31%, respectively. This is in contrast to the countries that produce the cheapest nuclear power, with Korea having 80% of their reactors based at a plant with 4 or more reactors, France 72%, China 74%, and Russia 85%. Economies of scale apply to generating sites.

The US in particular has most of their nuclear power plants based at sites with just 1 or 2 reactors, dramatically limiting any potential economies of scale, with fewer reactors being able to defray fixed per-site overheads. Such costs can be significant in a highly regulated safety-critical technology like nuclear. In contrast to the numbers above, 95% of reactors in Canada are based at a plant with 4 or more reactors.

So, what does this mean for Australia?

Given the potential economies of scale available and the relatively small size of Australia’s grid, Australia should focus on building larger nuclear power plants at a limited number of sites. A single station of the size of the Barakah station in the UAE would provide nearly all the baseload demand of a large city like Sydney or Melbourne. One large nuclear station replacing the two or three smaller coal plants that support each of these cities in the Hunter and Latrobe valleys, with existing levels of interconnection providing redundancy to other states, would be an obvious approach to consider, seeking where possible to utilise existing water and transmission assets. A similar approach may be suitable to replace coal capacity near Gladstone in Queensland. Smaller stations, potentially of smaller reactor sizes, could also be considered at later stages in more remote locations, but the expectation clearly set by global trends is that smaller nuclear stations would struggle to match the levelised cost of energy of larger reactors at larger sites.

BOX 1: UAE – Starting at scale

The recent construction of the Barakah nuclear power plant in the UAE is instructive. ENEC, the United Arab Emirates state-owned nuclear energy company, decided that any less than 4 reactors in the initial site would render the supporting industry and supply chains ‘anaemic’.[13]

Furthermore, they identified that by planning and building the water infrastructure for 6 reactors, rather than 4, they could dramatically reduce the overall cost of expanding to 6 reactors later. Taking decisions such as these would be difficult for a purely privately owned business entity, committing to enormous up-front costs with very long-term returns, but were deemed necessary and acted upon by ENEC, the Emirati state-owned company established to found their nuclear power sector.

By getting KEPCO, the Korean 51% state-owned company supplying the reactors, to take a significant stake in the nuclear entity that would operate the station, the UAE were able to align the interests of the entity designing and constructing the plants with that of operating the plant in the future.

The project is widely considered a successful nuclear build, running close to the scheduled time and budget. The first reactor commenced commercial operations in 2021, approximately 10 years after construction commenced. All 4 reactors will be running and supplying approximately 25% of the UAE’s power just 16 years after the publication of the initial white paper that marked the decision to adopt nuclear energy.

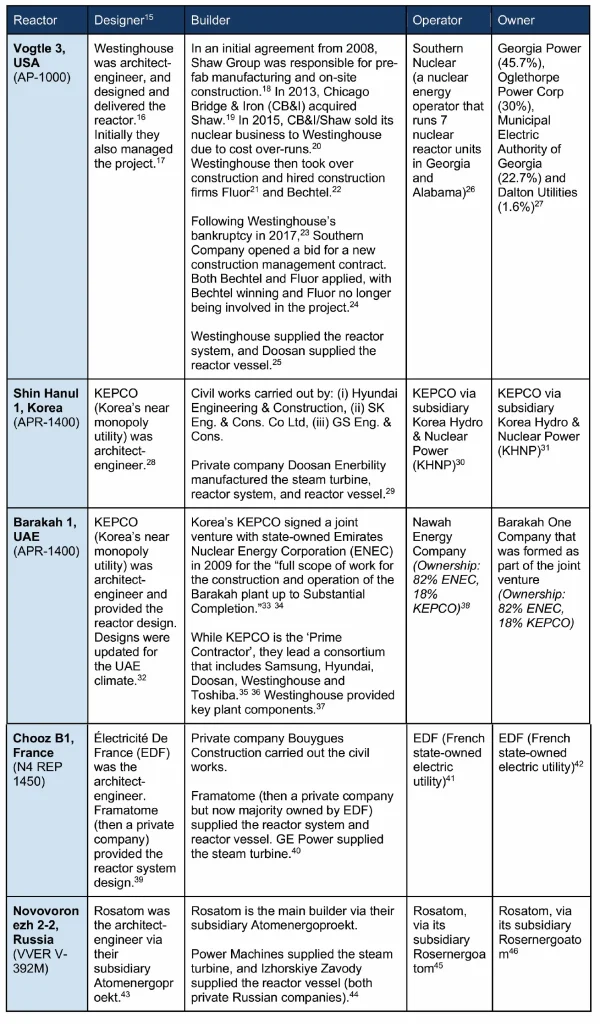

Lesson 3: Fewer independent corporate entities

Vertical Integration

Countries producing nuclear power differ widely in the extent of vertical integration in their nuclear industry. Some, like the US, have little vertical integration, often with different companies or organisations responsible for designing, building, owning and operating the plant.

Other countries have very deep vertical integration. In France, China, Russia and Korea, the same organisation is responsible for designing (or owning evolution of a supplied design), building, operating and owning the nuclear plants — and in some of these countries also responsible for transmission and distribution. While these organisations will often have different subsidiaries responsible for various aspects (e.g. construction versus operation), they will generally still be part of a larger organisation.

As the second column of Table 1 shows, countries with greater vertical integration in their nuclear power industry tend to also produce nuclear power at lower costs. Also, countries with more vertical integration tend to outperform in the export market (e.g., Russia, France, Korea) (see Appendix).

But why is this? The World Nuclear Association has found a key way of controlling costs is “aligning the interests of key stakeholders”.[14] Without aligned interests, ensuring suppliers fulfil expectations — of the operator, owner and regulators — requires time-consuming and expensive supervision. And if supervision is inadequate or misses something, there can be major consequences.

A particularly pointed case of interest misalignment is when the principal builder is contracted on a ‘cost-plus’ basis and therefore may not have a strong incentive to get the plant operating quickly in order to start generating revenue. In this case, their interests are misaligned with that of the owner or operator. The company building the plant should ideally have a significant interest in completing the plant as quickly as possible, while still ensuring efficient and reliable operations in the longer run.

The joint venture established for the Barakah power station between KEPCO (the Korean vendor/builder) and ENEC (the Emirati state-owned corporation) demonstrated an elegant means of re-aligning the interests of the relevant parties. The builder took an 18% stake in the corporate entity that would be responsible for the ongoing operations and maintenance of the nuclear power plant, which they were required to hold for several years after completion. This gave them an interest in ensuring the completion was timely, as well as to a high quality to ensure efficient operations. As an embarking nation, this is a likely candidate business structure for Australia.

KEPCO in Korea demonstrates an alternative structure for a very high level of vertical integration: A single company (KEPCO, which is 51% owned by the South Korean government) owns outright the different subsidiaries responsible for design, construction, maintenance and operation of the nuclear power plants.

A further consideration in favour of vertical integration is the intermittency of revenue associated with construction, particularly in countries that might not be large enough to maintain a ‘continuous build’ program. In the event of a gap of construction for a particular design in a particular country, entities that specialise entirely in a design or construction process might fold, or fail to maintain expertise and experience in that nuclear capability, during the hiatus.

Within a larger, more vertically integrated enterprise, revenues from operation of a long-lived plant might be naturally able to support the retention of skills and experience related to design and construction for strategic purposes. These might include mitigating the costs and risks associated with any regulatory change, or natural disaster in which modifications or refurbishments might be required, or to develop future options for the expansion of existing sites, or evolution of designs based on operational experience.

Table 2. Vertical integration in a selection of reactors across the globe.

Horizontal Integration

The presence of large, vertically integrated entities that might cover much of the design, construction, ownership and operation of nuclear power plants raises a clear question about how horizontally consolidated a successful nuclear industry might be. Put simply, how many credible alternative companies could offer competition?

It seems clear that only the very largest markets — perhaps the United States and China — could achieve multiple parallel alternatives of this scale. In Western Europe, the French state-owned EDF has now effectively taken control of the construction and operation of not only the French fleet, but also formerly private French nuclear construction companies (Framatome), and the British nuclear fleet as well.

The United States offers a contrast, in which multiple vendors of nuclear technology exist, and the ownership and operation of nuclear power plants is also relatively dispersed. However, the presence of multiple players in the US market doesn’t appear to have delivered lower construction costs. The US is now struggling to get any new orders placed for nuclear power plants, or export nuclear projects overseas as successfully as state-owned vertically integrated giants such as KEPCO, EDF, or Rosatom. Our survey suggests there is reason to think the competition advantages attained by keeping multiple players operating could be outweighed by concentrating experience and capacity in one.

This raises the question of whether nuclear energy infrastructure should be considered to have some aspects of a natural monopoly, as other elements of the energy system are. For example, when electric grids were first established in the United States, different companies ran competing transmission and distribution networks alongside their generation assets. However, it was soon accepted that consolidation of distribution networks within an area delivered greater overall benefits, and regulated monopolies were accepted as necessary for the scaling up of the electricity system.[47]

This doesn’t necessarily mean there isn’t scope for any competition in any parts of the nuclear industry. Contracts to supply services and machinery to support the nuclear industry might still be competitive where the expertise sufficiently overlaps with other use-cases for which multiple vendors would retain capabilities. The cleaners and gardeners at a nuclear facility need not be part of a state-backed vertically integrated giant. Many other aspects of machinery and construction might still be met by competitive sub-contracts to the owner/operator or Engineering Procurement and Construction (EPC) prime.

However, the more unique and specific the supplies or services become to nuclear construction, the less one can rely upon strong, consistent competition provided by the free market. This also applies to the EPC itself, where experience not only in nuclear construction, but construction of a particular design within a particular regulatory environment, might add to uniqueness that narrows the field of truly competitive bids. Things like designing, pouring, and inspecting nuclear-rated concrete, and forging and testing a nuclear reactor pressure vessel, will necessarily rely upon skills that wouldn’t otherwise be maintained in multiple competing entities domestically. An Australian project would either rely upon getting specialist foreign services that best fit the domestic project’s needs, or investing in creating and maintaining a sovereign capability domestically. Both come with attendant costs and risks, which should be carefully weighed.

Lesson 4: Accept government involvement

In the Appendix, we make a broad assessment of the degree of government involvement in the nuclear industry in each of the countries surveyed. We find the degree of government involvement closely follows the other degrees of concentration on designs, sites, and firms which appear in general to be desirable. Apparently, in nuclear, government involvement seems to work better than the free market on its own.

The countries with the cheapest construction costs surveyed are (starting with the cheapest): Korea, France, China and Russia. As the ‘Level of government involvement’ column in our more detailed survey table shows (see Appendix), all nuclear power generation in France and Russia comes from entities 100% owned by the state, while in China one of the key generation enterprises is 81% owned by the state, with the other 100% owned by the state. In Korea, the government owns a majority 51% of the state-owned enterprise responsible for generation. Canada is another example of a Western country in which all nuclear power plants are owned by the government (and most also operated by the government), resulting in relatively low construction costs.

The previous section highlights some of the reasons consolidation — both vertically and horizontally — might be considered beneficial or necessary. There is a clear potential need for government involvement in such consolidated entities, which might have characteristics of natural monopolies.

There are also further simple and compelling reasons that government involvement should be accepted and expected in a successful nuclear industry. Since nuclear power clearly benefits from scale and concentration, with large, consolidated nuclear power stations and corporate entities, there are obvious and benign reasons to expect the private market might not be able to bring about this outcome.

Scale

Any private company capable of bringing about this concentrated nuclear build approach would have to be exceedingly large. It’s a natural strategy for large corporates to diversify their investments in assets and projects so as not to be exposed to excessively large, singular risks. For a company to own a whole station of 4 or more GW scale reactors, it would have to be exceedingly large to incorporate that asset as part of a balanced risk strategy. Having a company own smaller plants, or individual reactors at a station limits the advantages of scale achieved by concentrating experience in a particular entity.

A better approach to this problem is to have a number of companies form a large consortium, whereby the risks of the very large venture are spread amongst the combined balance sheets of multiple entities. Most instances where nuclear power is privately owned reflect this kind of model, for instance in Finland, where the ‘Mankala’ model reflects this arrangement.[48] Private consortia also own reactors in Switzerland[49] and Sweden.[50]

However, diversifying ownership of nuclear to overcome the scale problem doesn’t naturally align with achieving the degree of vertical integration through design, construction, ownership and operation which appears to be associated with success. A private consortium built to amass a large enough balance sheet to own a large nuclear project doesn’t necessarily bring the necessary depth of experience in designing, building, or operating such a plant — and less often two or three of those aspects.

Such experience in all three could be acquired, but only with a massive and sustained effort, and successful efforts at this process appear to remain conspicuously concentrated around large, state-backed corporations. In the US, the private companies that have specialised in nuclear design or construction have not tended to become owner-operators of the plants they help develop.

Lifetime

Nuclear reactors have particularly long lifetimes, with many reactors in the US built in the 1970s or 1980s now applying for licenses to operate for up to 80 years.[51] However, the financing period for most corporate bonds tends to be much shorter. As a consequence, nuclear reactors tend to have very long economic ‘twilights’, where their capital has been paid off (after approximately 30 years) but they continue to provide extremely low-cost power for as long, or longer, again. It’s acknowledged by most sources that this amortised nuclear energy is extremely cheap.[52]

However, it is difficult for private entities to value this potentially long twilight period in making an investment decision. This is partly because the license for the full operating life is not granted at the time of the investment, and hence cannot be counted on, which might be appropriate given the importance of conducting checks and potential upgrades or refurbishments as the asset ages. An investor must make parallel investments in multiple assets for the ‘average’ expected life to be reliably attained.

This is also due to the commercial return evaluated by discounted cashflow models used in the private sector being extremely sensitive to assumptions around discount or interest rates. Unless very low interest rates are assumed, even large benefits in the distant future are evaluated as being extremely small by private investors. Governments have the ability to borrow at lower interest rates and should also take an interest in the long-term interests of their citizens, and hence may be more likely to put a higher weighting on the future benefits of such long-lived assets.

Uncaptured Benefits

Private investors in the free market must ensure there is a financial return on their investment. However, not all the benefits of nuclear power result in a direct return to the investor in that power station. For example:

- National security benefits: Many countries have increased their use of nuclear power in order to improve their energy security and become less reliant on foreign powers who might control access to alternative energy sources.[53] However, this benefit isn’t necessarily manifest in the financial returns to a nuclear energy investor. A nation as a whole benefits from this, which is one obvious reason a government might take an interest in nuclear power.

- Environmental benefits: Nuclear power has extremely low full-lifecycle emissions; much lower than solar.[54] However, without a carbon tax or trading scheme that has clear support from both sides of politics and can be relied upon to remain in place, it isn’t possible for this benefit to be captured financially by a nuclear energy investor making a multi-decade investment in a power station.

- Power system benefits: The qualities of nuclear power have significant benefits for the whole of a power system, reducing the need for other supporting infrastructure. Being reliable, dispatchable, and able to be concentrated on large sites, as opposed to being dispersed to attain weather diversity (i.e., for renewables), reduces the need for storage and transmission. The inertia nuclear-powered steam-turbines provide removes the need for spinning condensers or other means of ensuring system strength and frequency stability. Not all of these benefits to the whole system are adequately captured in the market price for electricity or ancillary services.

As such, given an individual private company would struggle to capture (through financial payments) the wider benefits to the power system, nation and globe, there’s a strong case that a government would need to be involved in driving the investment in nuclear.

Uncontrolled Financial Risks

The financial return on a nuclear power investment is extremely sensitive to construction time and cost, as well as any significant outages of the power station beyond what would normally be planned for. One of the most likely and largest causes of construction delays or prolonged shutdowns would be changes in the regulatory requirements on the construction or operation of a nuclear power plant. This makes the business case for nuclear particularly sensitive to regulatory risk. For example, changes in the requirement for aircraft impacts were a significant factor in the Vogtle nuclear power plant’s delays and cost escalation.[55]

Given that control of the regulatory framework justly rests with government, the risk that regulations will change is particularly hard for a private investor to assess and adequately price into a business plan. This is particularly the case where the regulator is newly established, or a new design is being licensed for the first time.

BOX 2: UK – Privatising to a foreign public company

The UK provides an interesting example of government involvement in nuclear energy. In their history, they have had 45 nuclear reactors in operation, all being built for government-owned entities between 1956 and 1995.[56] In the 1990s, the United Kingdom undertook a program of privatisation of energy assets. However, when the private company that held most of the UK’s nuclear assets (British Energy) ran into financial trouble in the early 2000s, the British government ended up re-investing and restructuring the company, before selling it in 2008 to the Électricité de France (EDF).

Being a French state-owned company, this means that all of the UK’s nuclear assets have ended up in the hands of the French government.[57] Now the UK’s efforts to re-build nuclear (e.g., at Sizewell and Hinkley Point) under a privatised system are also being handled by EDF. The lesson appears to be that large consolidated state-owned enterprises tend to dominate the global nuclear marketplace. An aversion to government-involvement in nuclear power might simply result in reliance on a foreign government to own, operate and renew a domestic nuclear fleet.

Conclusion

The data offers some remarkably clear insights. Nuclear energy programs benefit from concentration: concentrating on a limited number of reactor designs, concentrating more reactors onto a few very large sites. Countries that have done this consistently tend to have lower nuclear construction costs than countries that disperse their reactors across more, smaller stations, and disperse their industrial effort and experience across a larger number of different designs.

This finding has serious implications for the involvement of government in the nuclear energy sector. Market-led, government-enabled nuclear power (the current policy of the United States) has no track record outside the US, and the failure of the US to get significant new orders placed — despite the stated objective of doing so[58] — raises serious doubts as to whether it is working there either.

It may be that nuclear energy should be considered something of a natural monopoly, like other energy infrastructure such as transmission, distribution, or large hydro dams. It’s better to get it done once, properly, by a single competent (government owned or regulated) player, than expect competition between multiple different offerings to push prices down.

The data clearly show that countries with faster, cheaper builds, focusing on fewer designs and sites, often have a higher level of government participation in the nuclear sector. This involvement typically involves concentrating ownership within a single government entity or a partially government-owned organisation, which oversees the entire process of building, owning, and operating the nuclear plant.

It’s noteworthy that countries with this arrangement (such as France, Korea, and Russia) have been capable and willing to build new reactors domestically and export abroad, while the US is struggling to build at home, and has less credible export capability than France, Russia, Korea, and Canada.

As the debate around nuclear energy progresses, Australian policymakers would do well to seriously consider the lessons from other countries that have successfully used nuclear energy to provide cheap, clean and reliable energy for their citizens.

Appendix: Detailed cross-country survey of the nuclear industry

Notes to table:

- Reactors per station calculated for all nuclear power plants that are either currently in operation, under suspended operations (some reactors in Japan), or under construction. Nuclear plants where all reactors have been permanently shut down were not included in the analysis. If a series of reactors are built and connected to the grid, the next reactors must be connected within 30 years to be considered part of the same station.

- OCC = Overnight Construction Costs (i.e., excludes the costs of financing, operations and maintenance, etc). Costs data was originally in 2010 USD but has been converted to 2023 AUD.

- ‘No. of reactors exported’ is the number of reactors that are in operation at 31 December 2022, and whose Nuclear Steam Supply System (NSSS) was supplied by a company/organisation from the given country. Reactors whose NSSS was supplied by a cross-country consortium have been excluded on the basis that these reactors are not direct exports of a country’s technology to another country but are more of a partnership model.

- ‘Different designs’ are distinguished based on the number of loops, containment system, etc.

- Zongyuan, Zoe Liu. 2022. “Renewing America’s Leadership in the Global Civil Nuclear Energy Market.” June 22, 2022. Council on Foreign Relations. https://www.cfr.org/blog/renewing-americas-leadership-global-civil-nuclear-energy-market.

Sources:

- Government involvement and vertical integration – World Nuclear Association. “Country Profiles.” https://world-nuclear.org/information-library/country-profiles.aspx.

- Number of types of reactors and reactors per station – International Atomic Energy Agency. 2023. “Nuclear Share of Electricity Generation in 2022.” https://pris.iaea.org/PRIS/WorldStatistics/NuclearShareofElectricityGeneration.aspx.

- Overnight construction costs and construction time – Data based on Portugal-Pereira, J., P. Ferreira, J. Cunha, A. Szklo, R. Schaeffer, and M. Araújo. 2018. “Better Late than Never, but Never Late Is Better: Risk Assessment of Nuclear Power Construction Projects.” Energy Policy 120 (C): 158–66. https://econpapers.repec.org/article/eeeenepol/v_3a120_3ay_3a2018_3ai_3ac_3ap_3a158-166.htm. The following updates were made: Removed the Virgil C. Summer Nuclear Power Station reactors, updated Vogtle 3 to enter commercial operation in 2024 rather than 2020, and updated Vogtle 4 to enter commercial operation in 2024 (as is currently expected).

- Number of reactors exported – International Atomic Energy Agency. 2022. “Nuclear Power Reactors in the World.” https://www-pub.iaea.org/MTCD/Publications/PDF/RDS-2-42_web.pdf.

Endnotes

[1] Bahadori, Alireza, Gholamreza Zahedi, and Sohrab Zendehboudi. 2013. “An Overview of Australia’s Hydropower Energy: Status and Future Prospects.” Renewable and Sustainable Energy Reviews 20: 565–69. https://doi.org/10.1016/j.rser.2012.12.026.

[2] Parkinson, Giles. 2024. “Nuclear Slow and Expensive, Renewables Fast and Cheap: Bowen Slaps down Coalition ‘Fantasy.’” Renew Economy. March 7, 2024. https://reneweconomy.com.au/nuclear-slow-and-expensive-renewables-fast-and-cheap-bowen-slaps-down-coalition-fantasy/.

[3] CSIRO. 2023. “2023-24 GenCost Consultation Draft Released.” CSIRO. December 21, 2023. https://www.csiro.au/en/news/all/news/2023/december/2023-24-gencost-consultation-draft–released; Bowen, Chris. 2023. “Five serious answers why nuclear is the wrong solution for Australia.” Australian Financial Review. August 29, 2023. https://www.afr.com/policy/energy-and-climate/five-serious-answers-why-nuclear-is-the-wrong-solution-for-australia-20230827-p5dzqa; Driver, George. 2021. “Are Renewables the Cheapest New Source of Power?”. Australian Associated Press. February 11, 2021. https://www.aap.com.au/factcheck/are-renewables-the-cheapest-new-source-of-power/.

[4] Graham, Paul, Jenny Hayward and James Foster. 2023. “GenCost 2023-24 Consultation Draft”. CSIRO. p x. https://www.csiro.au/-/media/Energy/GenCost/GenCost2023-24Consultdraft_20231219-FINAL.pdf.

[5] World Nuclear Association. 2024. “Nuclear Power in the World Today.” World Nuclear Association. March 2024. https://world-nuclear.org/information-library/current-and-future-generation/nuclear-power-in-the-world-today.aspx.

[6] Lovering, Jessica R., Arthur Yip, and Ted Nordhaus. 2016. “Historical Construction Costs of Global Nuclear Power Reactors.” Energy Policy 91 (April): 371–82. https://doi.org/10.1016/j.enpol.2016.01.011.

[7] Potter, Brian. 2003. “Why Does Nuclear Power Plant Construction Cost So Much?” Institute for Progress. https://ifp.org/nuclear-power-plant-construction-costs/#conclusion.

[8] Benson, Andrew G. 2022. “Global Divergence in Nuclear Power Plant Construction: The Role of Political Decentralization.” Nuclear Technology 208 (6): 947–89. https://doi.org/10.1080/00295450.2021.1991762.

[9] OCC and construction time data sourced from Portugal-Pereira, J., P. Ferreira, J. Cunha, A. Szklo, R. Schaeffer, and M. Araújo. 2018. “Better Late than Never, but Never Late Is Better: Risk Assessment of Nuclear Power Construction Projects.” Energy Policy 120 (C): 158–66. https://econpapers.repec.org/article/eeeenepol/v_3a120_3ay_3a2018_3ai_3ac_3ap_3a158-166.htm.

Note: Reactors that commenced construction before 1980 and microreactors (<20 kW) were excluded. For France and Russia, construction time data was calculated excluding reactors that started construction in 1983-89, as construction was paused at several sites in these countries following the 1986 Chernobyl disaster.

[10] Entergy Corporation. 2024. “Arkansas Nuclear One.” https://www.entergy-nuclear.com/sites/arkansas-nuclear-one/; International Atomic Energy Agency. 2024. “PRIS – Country Statistics.” https://pris.iaea.org/PRIS/CountryStatistics/CountryStatisticsLandingPage.aspx.

[11] OECD and Nuclear Energy Agency. 2020. “Unlocking Reductions in the Construction

Costs of Nuclear: A Practical Guide for Stakeholders”. https://www.oecd-nea.org/upload/docs/application/pdf/2020-07/7530-reducing-cost-nuclear-construction.pdf.

[12] Shirvan, Koroush. 2022. “Overnight Capital Cost of the Next AP1000”. Massachusetts Institute of Technology Centre for Advanced Nuclear Energy Systems. https://web.mit.edu/kshirvan/www/research/ANP193%20TR%20CANES.pdf.

[13] Decouple Media. 2023. “UAE Goes Nuclear (CEO Interview).” YouTube. April 11, 2023. https://www.youtube.com/watch?v=6vtc3fD_jvc.

[14] World Nuclear Association. 2018. “Lesson-learning in Nuclear Construction Projects”. https://world-nuclear.org/getattachment/e9c28f2a-a335-48a8-aa4f-525471a6795a/REPORT-Lesson-learning-in-Nuclear-Construction.pdf.aspx.

[15] We define ‘designer’ as the organisation that is the vendor of the Nuclear Steam Supply System (NSSS), as well as the architect-engineer. In many nuclear power plants, especially older plants in the US, these roles are different, however this is not the case for our case study plants here.

[16] The Nuclear Steam Supply System (NSSS) includes the nuclear reactor itself and the system for sending steam out through pipes. This can be thought of as the ‘core’ and most important part of the nuclear reactor, which the rest of the reactor is designed around.

[17] Macalister, Terry. 2008. “Westinghouse Wins First US Nuclear Deal in 30 Years.” The Guardian, April 9, 2008. https://www.theguardian.com/world/2008/apr/10/nuclear.nuclearpower.

[18] Ibid.

[19] Business Wire, 2012. “CB&I Announces Agreement to Acquire the Shaw Group.” July 30, 2012. https://www.businesswire.com/news/home/20120730005581/en/CBI-Announces-Agreement-to-Acquire-the-Shaw-Group.

[20] Pentland, William. 2015. “Why Chicago Bridge & Iron ‘Sold’ Its Nuclear Business to Westinghouse for a $1B Loss.” Forbes, October 29, 2015. https://www.forbes.com/sites/williampentland/2015/10/29/why-chicago-bridge-iron-sold-its-nuclear-business-to-westinghouse/?sh=2dc51d9c1c70.

[21] Fluor. 2015. “Fluor Corporation Named by Westinghouse Electric Company to Manage Construction of Nuclear Power Projects.” October 27, 2015. https://newsroom.fluor.com/news-releases/news-details/2015/Fluor-Corporation-Named-by-Westinghouse-Electric-Company-to-Manage-Construction-of-Nuclear-Power-Projects/default.aspx.

[22] Clarion Energy Content Directors. 2017. “Report: Problems with Summer Expansion Were Apparent Last Year.” Power Engineering. September 5, 2017. https://www.power-eng.com/nuclear/report-problems-with-summer-expansion-were-apparent-last-year/#gref.

[23] DiNapoli, Jessica and Makiko Yamazaki. 2017. “Toshiba’s Westinghouse brings in bankruptcy lawyers; disclosure deadlines loom.” Reuters, March 9, 2017. https://www.reuters.com/article/us-toshiba-accounting-idUSKBN16G0QO/.

[24] Proctor, Darrell. 2017. “Bechtel In, Fluor out as Vogtle Construction Continues.” Power Magazine. August 31, 2017. https://www.powermag.com/bechtel-in-fluor-out-as-vogtle-construction-continues/.

[25] Global Data. 2024. “Power Plant Profile: Vogtle 3, US.” Power Technology. January 31, 2024. https://www.power-technology.com/marketdata/power-plant-profile-vogtle-3-us/.

[26] Ibid.

[27] Ibid.

[28] Global Data. 2024. “Power Plant Profile: Shin Hanul 1 (Shin-Ulchin 1), South Korea.” Power Technology. January 31, 2024. https://www.power-technology.com/marketdata/power-plant-profile-shin-hanul-1-shin-ulchin-1-south-korea/?cf-view.

[29] Ibid.

[30] Ibid.

[31] Ibid.

[32] Global Data. 2024. “Barakah Nuclear Power Plant.” Power Technology. February 3, 2024. https://www.power-technology.com/projects/barakah-nuclear-power-plant-abu-dhabi/?cf-view.

[33] Emirates Nuclear Energy Corporation. 2022. “Agreements.” https://www.enec.gov.ae/about-us/agreements/.

[34] In addition to the ‘Prime Contract’ agreement for construction with KEPCO, ENEC’s ‘Agreements’ webpage lists several ongoing operations agreements between operator Nawah and KEPCO subsidiaries (e.g., owner and operator of Korean nuclear plants KHNP, KEPCO Engineering & Construction), Doosan Heavy Industries, and foreign firms.

[35] BBC News. 2009. “South Korea Wins Nuclear Contract.” BBC News, December 27, 2009. http://news.bbc.co.uk/2/hi/8431904.stm.

[36] Note that Toshiba had majority ownership of Westinghouse from 2006-17.

[37] Nuclear Engineering International. 2015 “Westinghouse Sets up in Abu Dhabi.” May 31, 2015. https://www.neimagazine.com/news/newswestinghouse-sets-up-in-abu-dhabi-4590160.

[38] Emirates Nuclear Energy Corporation. 2022. “Joint Venture.” https://www.enec.gov.ae/about-us/leadership-and-governance/joint-venture.

[39] Power Technology. 2021. “Chooz B1, France.” Power Technology. November 19, 2021. https://www.power-technology.com/marketdata/chooz-b1-france/?cf-view&cf-closed.

[40] Ibid.

[41] Ibid.

[42] Ibid.

[43] Global Data. 2024. “Power Plant Profile: Novovoronezh II 2, Russia.” Power Technology. January 31, 2024. https://www.power-technology.com/marketdata/power-plant-profile-novovoronezh-ii-2-russia/.

[44] Ibid.

[45] Ibid.

[46] Ibid.

[47] Potter, Brian. 2023. “The Birth of the Grid.” Construction Physics. May 25, 2023. https://www.construction-physics.com/p/the-birth-of-the-grid.

[48] Kulmala, Ville. 2023. “The Mankala Model Is a Cornerstone of Finnish Energy Production.” TVO. February 1, 2023. https://www.tvo.fi/en/index/news/pressreleasesstockexchangereleases/2023/themankalamodelisacornerstoneoffinnishenergyproduction.html.

[49] Unwin, Jack. 2019. “The World’s Oldest Nuclear Power Plant Still in Operation.” Power Technology. October 16, 2019. https://www.power-technology.com/features/worlds-oldest-nuclear-power-plant/?cf-view; Global Data. 2024. “Power Plant Profile: Gosgen Rebuild, Switzerland.” Power Technology. January 31, 2024. https://www.power-technology.com/marketdata/power-plant-profile-gosgen-rebuild-switzerland/; Global Data. 2024. “Power Plant Profile: Leibstadt, Switzerland.” Power Technology. February 3, 2024. https://www.power-technology.com/marketdata/power-plant-profile-leibstadt-switzerland/.

[50] Global Data. 2024. “Power Plant Profile: Oskarshamn 3, Sweden.” Power Technology. February 3, 2024. https://www.power-technology.com/marketdata/power-plant-profile-oskarshamn-3-sweden/?cf-view.

[51] Office of Nuclear Energy. 2020. “What’s the Lifespan for a Nuclear Reactor? Much Longer than You Might Think.” U.S. Department of Energy. April 16, 2020. https://www.energy.gov/ne/articles/whats-lifespan-nuclear-reactor-much-longer-you-might-think.

[52] Lazard. 2023. “2023 Levelized Cost of Energy+.” Lazard. April 12, 2023. https://www.lazard.com/research-insights/2023-levelized-cost-of-energyplus/.

[53] Nuclear Energy Institute. 2024. “Energy Security.” https://www.nei.org/advantages/energy-security.

[54] World Nuclear Association. 2021. “How Can Nuclear Combat Climate Change?” https://world-nuclear.org/nuclear-essentials/how-can-nuclear-combat-climate-change.aspx.

[55] Adams, Rod. “NRC’s Imposition of Aircraft Impact Rule Played a Major Role in Vogtle Project Delays and VC Summer Failure.” 2023. Atomic Insights. February 24, 2023. https://atomicinsights.com/nrcs-imposition-of-aircraft-impact-rule-played-a-major-role-in-vogtle-project-delays-and-vc-summer-failure/.

[56] International Atomic Energy Agency. 2024. “PRIS – Country Statistics.” https://pris.iaea.org/PRIS/CountryStatistics/CountryStatisticsLandingPage.aspx.

[57] Gow, David. 2008. “EDF Takeover of British Energy Cleared.” The Guardian. December 22, 2008. https://www.theguardian.com/business/2008/dec/22/british-energy-edf-nuclear.

[58] Office Of the Spokesperson. 2023. “The United States Joins Multinational Declaration to Triple Nuclear Energy Capacity by 2050 to Support Global Climate and Energy Security Goals.” United States Department of State. December 2, 2023. https://www.state.gov/the-united-states-joins-multinational-declaration-to-triple-nuclear-energy-capacity-by-2050-to-support-global-climate-and-energy-security-goals/.